Are you a Manufacturing Business That Was Impacted by the Covid Pandemic? Apply for this Free Manufacturing Company Small Business Grant

You May Qualify for up to $26,000 per W2 Full-Time Employee. To qualify this Free US grant, your business needed to have had 5 to 500 full time W2 employees in 2020 or 2021 or both which is based on your past US Income tax returns. This is the largest small business grant in US history that has been created for covid relief and recovery

Limited Time Small Business Grant Opportunity! Hurry Before Time Runs Out!

Sign Up in Just a Few Minutes For Free Below

(An ERC Together Specialist rep will follow up to verify your eligibilityand answer any questions you may have)

Are you a Business

Owner That Was Impacted by the Covid Pandemic?

You May Qualify for up to $26,000 per W2 Full-Time Employee. To qualify Your US business needed to have had 5 to 500 full time W2 employees in 2020 and or 2021 which is based on your past US Income tax returns. This is the largest small business grant in US history that has been created for covid relief and recovery

Limited Time Grant Opportunity! Hurry Before Time Runs Out!

Sign Up in Just a Few Minutes For Free Below

(An ERC Together Specialist rep will follow up to verify your eligibilityand answer any questions you may have)

Are you a

Business Owner That Was Impacted by the Covid Pandemic?

You May Qualify for up to $26,000 per W2 Full-Time Employee. To qualify Your US business needed to have had 5 to 500 full time W2 employees in 2020 and or 2021 which is based on your past US Income tax returns. This is the largest small business grant in US history that has been created for covid relief and recovery

Limited Time Grant Opportunity! Hurry Before Time Runs Out!

Get Qualified in Minutes For Free Below

(An ERC Together Specialist rep will follow up to verify your eligibility to proceed with application and any questions)

Are you a

Business

Owner That Was Impacted by the Covid Pandemic?

You May Qualify for up to $26,000 per W2 Full-Time Employee. To qualify Your US business needed to have had 5 to 500 full time W2 employees in 2020 and/ or 2021 which is based on your past US Income tax returns. This is the largest small business grant in US history that has been created for covid relief and recovery

Watch the Video below to get more info about the Earned Income Tax Credit and answer a short 5 question survey to see if you qualify

Are you a

Business

Owner That Was Impacted by the Covid Pandemic?

You May Qualify for up to $26,000 per W2 Full-Time Employee. To qualify Your US business needed to have had 5 to 500 full time W2 employees in 2020 and or 2021 which is based on your past US Income tax returns. This is the largest small business grant in US history that has been created for covid relief and recovery

Limited Time Grant Opportunity! Hurry Before Time Runs Out!

Get Qualified in Minutes For Free Below

(An ERC Together Specialist rep will follow up to verify your eligibility to proceed with application and any questions)

Do You Have a Manufacturing Business That Was Impacted by the Covid Pandemic? Apply for this Free Manufacturing Company Small Business Grant

Watch the Video below to get more info about the Earned Income Tax Credit and answer a short 5 question survey to see if you qualify

You May Qualify for Covid Relief Assistance of up to $26,000 per W2 Full-Time Employee. To qualify Your US business needed to have had 5 to 500 full time W2 employees in 2020 and/ or 2021 which is based on your past US Income tax returns. This is the largest small business grant in US history that has been created for covid relief and recovery

Manufacturing Company Small Business Grant Information

In the dynamic landscape of manufacturing, staying competitive and thriving as a small business can be challenging. One powerful avenue to help your manufacturing company flourish is by tapping into small business grants.

In this comprehensive guide, we'll delve into the Employment Retention Tax Credit (ERTC) and how Showspaces' affiliate partner, ERC Together, can assist you in securing this vital financial lifeline.

Section 1: Understanding the Employment Retention Tax Credit (ERTC)

Unlocking ERTC Benefits for Your Manufacturing BusinessThe Employment Retention Tax Credit (ERTC) is a valuable federal program designed to help businesses, including manufacturing companies, retain their employees during difficult times. It provides a refundable tax credit equal to a percentage of qualified wages paid to employees.

Qualifying Criteria for ERTC:To be eligible for ERTC, your manufacturing company must meet certain criteria, such as:

Experiencing a Significant Decline in Revenue: Your business should have experienced a significant drop in gross receipts compared to a previous period.Participation in Government-Ordered Shutdowns: If your manufacturing operations were partially or fully suspended due to government orders, you may qualify for ERTC.Employee Retention: To claim the credit, you must retain your employees, making it an ideal solution for manufacturers looking to keep their workforce intact.

Section 2: The enefits of ERTC for Manufacturing Companies

Boosting Your Bottom LineBy leveraging the ERTC program, your manufacturing business can experience several key advantages:

Substantial Tax Savings: ERTC offers a refundable tax credit of up to $7,000 per employee per quarter, potentially leading to significant tax savings.Cash Flow Enhancement: ERTC can provide an immediate cash flow boost, allowing you to reinvest in your business, purchase new equipment, or expand your operations.Employee Retention: Keeping your skilled workforce during challenging times is essential for maintaining production quality and efficiency.

Section 3: How ERC Together Can Help Your Manufacturing Business

Navigating the ERTC Process with ConfidenceERC Together, Showspaces' trusted affiliate partner, is your reliable partner in securing the ERTC for your manufacturing company.

Here's how they can assist you:

Expert Guidance: ERC Together boasts a team of tax experts well-versed in the complexities of ERTC. They'll help you understand eligibility, calculate credits, and file with confidence.Streamlined Processing: Time is of the essence when applying for ERTC. ERC Together's efficient processing ensures you receive your refund as quickly as possible.Peace of Mind: With ERC Together by your side, you can focus on your manufacturing operations, knowing that your tax matters are in capable hands.

Section 4: How to Apply for ERTC with ERC Together

Taking the First Step Toward Financial SecurityGetting started with ERC Together is a breeze:

Contact ERC Together: Reach out to ERC Together through Showspaces' referral to begin your journey.Gather Necessary Documentation: ERC Together will guide you in collecting the required financial and employee data for your application.Let ERC Together Work Their Magic: Once you've submitted your documentation, ERC Together will take over the application process, ensuring you maximize your ERTC benefits.

Section 5: Realizing the Potential of ERTC for Your Manufacturing Company

Secure Your Business's Future TodayDon't let financial uncertainties impede your manufacturing company's growth and success. The Employment Retention Tax Credit, facilitated by ERC Together, can be a game-changer for your small business.

By applying for ERTC, you not only bolster your finances but also ensure your workforce remains intact during challenging times. Showspaces' affiliate partner, ERC Together, is ready to guide you through the process, making it seamless and rewarding.So, take the first step towards securing your manufacturing business's future. Contact ERC Together today, and let them help you unlock the benefits of the Employment Retention Tax Credit for your small business.

Welcome to Credit Repair

WE HELP

TO GROW YOUR BUSINESS

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

How To Qualify For Up to Millions of Dollars Either as a Qualified US Business Owner or By Referring Qualified US Business Owners to this Small Business Grant

Check out this Video Example below on how your business can qualify for up to millions of dollars in small business grant funding if your US business was impacted by the Covid pandemic. Your US business must have had at least 5- 500 employees.

IF you are not a US Business Owner, You can still possibly make money with this smal business grant opportunity by by joining our team to refer qualified US Business Owners(click here to sign up as an affiliate)

If you refer a business that qualifies for a Million Dollars in small business grant funding, you can potentially make around $25,000 just for sucessfully referring business owners to ERC Together. This is the largest IRS Grant program in US history with the Employee Retention Tax Credit program. Whether or not your own business qualifies for the ERTC Tax Credit, this Referral Opportunity may also be open to you as well to make commissions just for helping qualify business owners for their income tax refund and helping them go through the process with ERC Together.

Test Out The Income Tax Refund Calculator Below to Preview How Much A Qualified Business Owner May Receive

GET SMALL BUSINESS GRANT RECOVERY RELIEF

How To Qualify For Up to Millions of Dollars Either as a Qualified US Business Owner or By Referring Qualified US Business Owners

Check out this Video Example below on how your business can qualify for up to millions of dollars in small business grant funding if your US business was impacted by the Covid pandemic. Your US business must have had at least 5- 500 employees.

IF you are not a US Business Owner, You can still possibly make money by by joining our team to refer qualified US Business Owners(click here to sign up as an affiliate)

If you refer a business that qualifies for a Million Dollars in small business grant funding, you can potentially make at least $25,000 just for sucessfully referring business owners to ERC Together that qualify and get their their income tax refund processed through ERC Together. This is the largest IRS Grant program in US history with the Employee Retention Tax Credit program. Whether or not your own business qualifies for the ERTC Tax Credit, this Referral Opportunity may also be open to you as well to make commissions just for helping qualify business owners for their income tax refund and helping them go through the process with ERC Together.

Test Out The Income Tax Refund Calculator Below to Preview How Much A Qualified Business Owner May Receive

We Help Business Owners Who Were Impacted by the Pandemic Qualify for the Employment Retention Credit (ERC)

Are you a business owner or do you know a business owner that was affected by the Covid 19 Pandemic? If your business was impacted either financially or was restricted operation-wise from serving the community, you may qualify for covid relief in the form of a government tax refund.

Our company, Showspaces, is parterning up with ERC Together to let more business owners know that they may be entitles to this pandemic grant if they were affected in 2020 or 2021.

Watch the Video below to get more info about the Earned Income Tax Credit and answer a short 5 question survey to see if you qualify for this small business grant

Fill Out the Short 5 Question Survey Below to See if you Qualify

GET BUSINESS RECOVERY RELIEF

We Help Business Owners Who Were Impacted by the Pandemic Qualify for the Employment Retention Credit (ERC)

Are you a United States business owner or do you know a US business owner that was affected by the Covid 19 Pandemic? If your business was impacted either financially or was restricted operation-wise from serving the community, you may qualify for covid relief in the form of a government tax refund.

Our company, Showspaces, has partnered up with ERC Together to let business owners know that they may be entitles to this pandemic grant if they were affected in 2020 or 2021.

Watch the Video below to get more info about the Earned Income Tax Credit and answer a short 5 question survey to see if you qualify

Fill Out the Short Survey Below to See if you Qualify For Free

About Us

We Help Clients To Get Success

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Has Your Business Been Impacted by the Pandemic?

You could qualify for this Covid Relief Small Business Grant in the form of a Business Income Tax Credit

Various Types of Businesses May Qualify

There are various businesses that qualify which includes local businesses, nursing homes, churches, non-profit organications and even schools.

Fill Out The Short Survey Below And Use the Income Tax Calculator

Complete a short 5 question survey and use the calculator to get a preliminary estimate of how much of an income tax refund you can receive. Do you have questions or are not certain about your business info from 2020 and 2021? It's okay. ERC Together tax specialists will help you with your questions to determine if you qualify

Share With Business Owners Who May Need Financial Assistance

If you know of any business owners with at least 5-500 employees, they may qualify. Feel free to share this page to see if they qualify.

*Showspaces is an affiliate marketing partner with ERC Together and makes a commission for any referral that sign up with our referral link and receives a tax refund processed through tax specialists with ERC Together. No up-front fees are required as ERC Together only charges on the back end only after an income tax refund is process then received.

Looking for a Great Side Job Opportunity? If you are also interested in helping business owners while earning money through referrals as a sub-affiliate, click this link here to use out affiliate link to sign up to become sub-affiliate partner

Has Your Business Been Impacted by the Pandemic?

You could qualify for a Covid Relief Business Tax Grant in the form of a Business Income Tax Credit

Various Types of Businesses May Qualify

There are various businesses that qualify which includes local businesses, nursing homes, churches, non-profit organications and even schools.

Fill Out The Short Survey Below And Use the Income Tax Calculator

Complete a short 5 question survey and use the calculator to get a preliminary estimate of how much of an income tax refund you can receive. Do you have questions or are not certain about your business info from 2020 and 2021? It's okay. ERC Together tax specialists will help you with your questions to determine if you qualify

Share With Business Owners Who May Need Financial Assistance

If you know of any business owners with at least 5-500 employees, they may qualify. Feel free to share this page to see if they qualify. Or if you are interested in joining our Referal Team, click here to learn how to become a sub affiliate to make at least 10% in high commissions

*Showspaces is an affiliate marketing partner with ERC Together and makes a commission for any referral that sign up with our referral link and receives a tax refund processed through tax specialists with ERC Together. No up-front fees are required as ERC Together only charges on the back end only after an income tax refund is process then received.

Looking for a Great Side Job Opportunity? If you are also interested in helping business owners while earning money through referrals as a sub-affiliate, click this link here to use out affiliate link to sign up to become sub-affiliate partner

How We Can Help

OUR SERVICES

We Are Partnered With The Best ERC Tax Specialists

We are partnered with ERC Together, who specialize in qualifying and processing income tax refunds for small businesses that are eligible. Unlike general accountants who are focused on various tax laws overall, ERC Together solely focuses on qualifying business owners and processing their tax refunds specifically for the ERTC income tax credit so they can answer any specific questions you may have.

ERC Together has weekly orientations and onboarding sessions so sign up and ask them any questions you may have. If you are interested in also referring other businesses and earn a commission, you can use the

job referral link here

Start With Your Personal Network

Know Of Any Friends, Family Or People In The Community That Were Impacted By The Pandemic? Make Money By Helping People Recover From Hardship By Seeing If They Qualify For Tens Or Hundreds Of Thousands In US Government Income Tax Refund.

Make High Affiliate Commissions With This Easy Work From Home Job!

Make Commissions Helping Refer Business Owners To The Largest IRS Grant In US History With The Employee Retention Credit Program With ERC Together

Rebuild Your Community One Business at a Time

Small Businesses are the foundation of a good economy. By helping business owners recover from the pandemic, we are helping to rebuild the economy. Giving back to small business owners mean more money more funds will be available to hire more workers and more money will circulate through the economy once again.

By helping business owners qualify for small business grant funding, we are helping future generations get back what economic stability was once lost during the pandemic.

TRY THE INCOME TAX CALCULATOR

Complete a short 5 question survey and use the calculator to get a preliminary estimate of how much of an income tax refund you can receive.

Create Social Change

After attending the Onboarding session, you will be given more info on what paper work to submit which includes submitting independent contractor paperwork either for a W2 or W-8BEN. You can then connect Your preferred online payment method.

Once You Find A Qualified Business Owner That Gets Their Income Tax Refund Processsed As Your Referral, You Will Be Paid A Percent Commission By ERC Together Once The Business Owner Receives Their Payment.

MAKE MONEY AS AN AFFILIATE PARTNER

Do you want to make extra money just by referring other business owners? You can make commissions

What we do

Our Services

FINANCIAL CONSULTATION

Lorem Ipsum is simply dummy text

First, our partners gather some

information to verify

CREDIT REPORTS

Lorem Ipsum is simply dummy text

First, our partners gather some

information to verify

PLANNING & CONDUCTING

Lorem Ipsum is simply dummy text

First, our partners gather some

information to verify

FINANCIAL CONSULTATION

Lorem Ipsum is simply dummy text

First, our partners gather some

information to verify

CREDIT REPORTS

Lorem Ipsum is simply dummy text

First, our partners gather some

information to verify

PLANNING & CONDUCTING

Lorem Ipsum is simply dummy text

First, our partners gather some

information to verify

Time is Running out. Apply today!

The Employment Retention Tax Credit still has millions in funding that needs to be dispersed. However, apply now before time ends. ERTC grant funding is scheduled to end in 2025 or until funding runs out.

Limited Time Grant Opportunity! Hurry Before Time Runs Out!

Sign Up in Just a Few Minutes For Free Below

(An ERC Together Specialist rep will follow up to verify your eligibilityand answer any questions you may have)

Time is Running out. Apply today!

The Employment Retention Tax Credit still has millions in funding that needs to be dispersed. However, apply now before time ends. ERTC grant funding is scheduled to end in 2025 or until funding runs out.

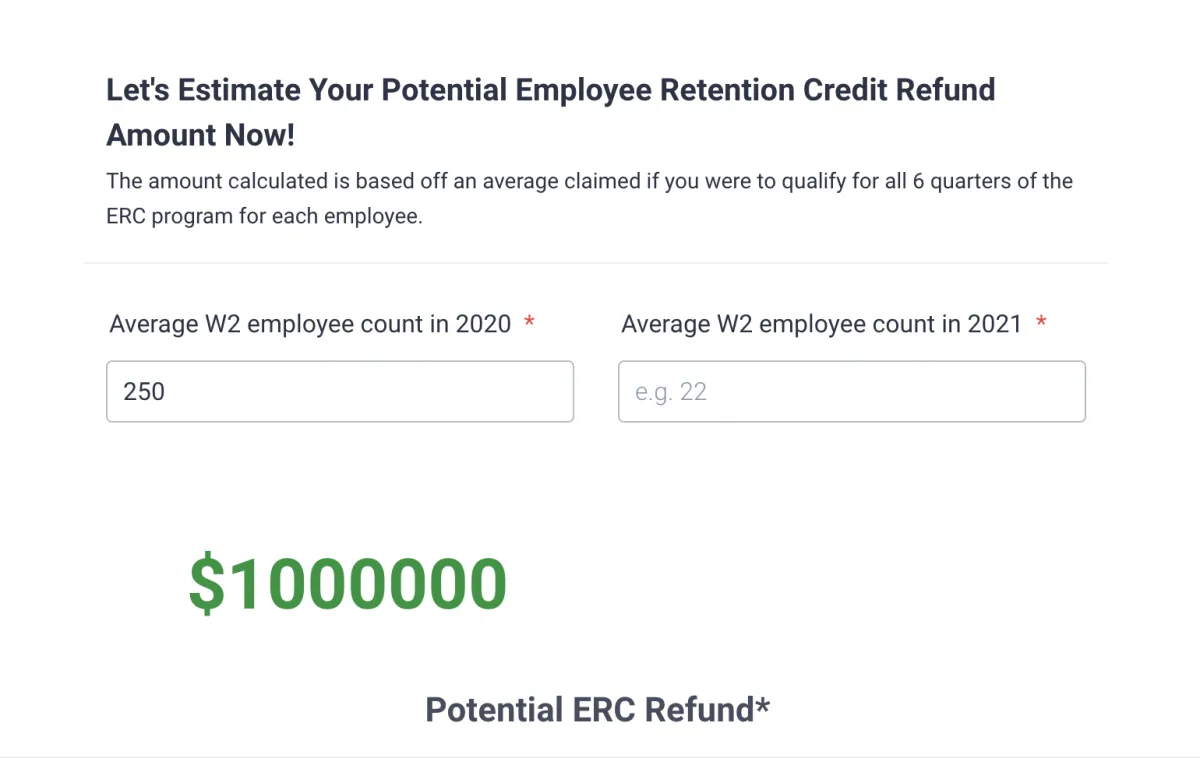

Help business Owners Potentially Get Millions in Tax Refund Money

ERC Together's Income Tax survey also comes with a Tax Refund Calculator. You can quickly generate a refund estimate for a prospective business owner by entering the number of W2 Employees in 2020 and 2021.. See the right screenshot example on how much a company with 250 employees can potentially earn

Million Dollar Tax Refund Example:

If a Nursing Care Facility for instance had 250 employees in 2020, you can put "250" for 2020. According to the Tax Refund calculator they may receive $1,000,000 as a total Potential ERC Refund*.

Screenshot of Tax Refund Calculator Example Below

*Note from ERC Together: This is an estimate only based off the employee counts entered and does not represent a guarantee of the credit amount you will receive, or that you will qualify for the program. ERC Together DOES NOT provide any legal, tax or financial advice. The information on this website is for informational purposes only. You should consult an attorney or C.P.A before making any business, tax or financial decisions.

How to Make $25,000 in Commissions Just From Referring Business Owners

Check out this Video Example on how you can also help business owners qualify for a million dollars while also getting $25,000 for Referring them to ERC Together for the largest IRS Grant in US history program with the Employee Retention Credit program. Whether or not your own business qualifies for the ERTC Tax Credit, this Referral Opportunity may also be open to you as well to make commissions just for helping qualify business owners for the income tax refund and helping them go through the process with ERC Together.

Test Out The Income Tax Refund Calculator Below to Preview How Much A Qualified Business Owner May Receive

How to Make $25,000 in Commissions Just From Referring Business Owners

Check out this Video Example on how you can also help business owners qualify for a million dollars while also getting $25,000 for Referring them to ERC Together for the largest IRS Grant in US history program with the Employee Retention Credit program. Whether or not your own business qualifies for the ERTC Tax Credit, this Referral Opportunity may also be open to you as well to make commissions just for helping qualify business owners for the income tax refund and helping them go through the process with ERC Together.

Test Out The Income Tax Refund Calculator Below to Preview How Much A Qualified Business Owner May Receive

Get your FREE online credit

evaluation now

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's.

Staff

Our Team

Jasika Fersh

Founder

Ron Bil

CEO

Robin Cattor

Advicer

Staff

Our Team

Jasika Fersh

Founder

Ron Bil

CEO

Robin Cattor

Advicer

History

History Of Our Company

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

History

History Of Our Company

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

1500+

Successful Project

242+

Running Project

250+

Happy Clients

1500+

Successful Project

242+

Running Project

250+

Happy Clients

What client say about us

Lorem Ipsum is simply dummy text of the printing

and typesetting industry. Lorem Ipsum has been

he industry's standard dummy text ever since the

1500s, when an unknown printer took a galley of

type and scrambled.

Darcel Ballentine

Barone LLC.

Lorem Ipsum is simply dummy text of the printing

and typesetting industry. Lorem Ipsum has been

he industry's standard dummy text ever since the

1500s, when an unknown printer took a galley of

type and scrambled.

Leatrice Handler

Acme Co.

Frequently Asked Question

What is Lorem Ipsum?

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

What is Lorem Ipsum?

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

What is Lorem Ipsum?

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

What is Lorem Ipsum?

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

What client say about us

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

Darcel Ballentine

Barone LLC.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

Leatrice Handler

Acme Co.

Get your FREE online credit

evaluation now

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's.

Amet minim mollit non deserunt

ullamco est sit aliqua dolor do amet

sint. consequat duis enim velit mollit.

Quick Links

About Us

Services

Contact Us

Social Media Links

Contact Us

(000) 000-0000

Info@gohighlevel.com

2972 Westheimer Rd. Santa

Ana, Illinois 85486

©2022 – Go High Level | All Right Reserved

Want to Also earn

high commission by

referring business owners?

Check out our Easy Work From Home Site Below

*Showspaces is an affiliate marketing partner with ERC Together and makes a commission for any referral that sign up for this small business grant with our referral link and receives a tax refund processed through tax specialists with ERC Together. No up-front fees are required as ERC Together only charges on the back end only after an income tax refund is process then received by the business owner.

FAQ's (Frequently Asked Questions)

Who Qualifies For the ERC Grant Tax Refund?

You Need to have been a Unitied States Business Owner. Your company needed to have had 5-500 Full Time W2 Employees either in 2020 or 2021 or both years. Your Businessness also had to have been impacted by Covid Financially or situationally.

What Hardship Factors Qualify Your Business For Covid Relief Funding for ERTC?

This includes:

Full Shut Down

Interrupted Operations

Reduction in Capacity

Supply Chain Disruptions

Revenue reduction in 2020

Partial Shutdown

Reduction in Hours

inability to Travel for Business

Inability to Work with Customers

Revenue Reduction in 2021

Can I qualify if I am not a US Business Owner?

If you are not a business owner with a business operating in 2020 or 2021, you may not qualify for the ERTC . However you might still be able to make money doing referrals by becoming a referral partner. Check out our partner website: Easyworkfromhomejob.com

When is the ERTC Grant Deadline?

While 2020 and 2021 tax years have passed, you can still apply for the ERTC Income Tax Refund. The Grant may go on through 2023 and end in 2025 OR until ERTC Funding completely Runs out. So it is only available for a limited time! Apply Today!

IS ERC/ERTC the same thing as PPP (Payment Protection Program?)?

While both program originated out of a similar federal bill, both programs were different. PPP was supposed to be for independent contractors and was a forgiveable loan that you can apply to be forgiven by the US government, otherwise you would have to pay it back. Whereas ERC/ERTC was made for business owners with 5 to 500 W2 full time employees in size anytime time throughout either year. ERTC stands for Employee Retention Credit and rewarded businesses for staying open during the pandemic in 2020 or 2021 or both years. It is a tax refund which does not have to be paid back.

Did the IRS Stop all ERC referrals as of September 2023?

As of September 2023, the Internal Revenue Service has put a temporary moratorium on processing new grant referral applications through at least December 2023 in order to implement more safeguards against fraud and scams.

However, busines owners can still sign up here to be placed on waitlist to be processed as soon IRS gives the green light to resume processing grant refund check applications. So don't wait to sign up otherwise you may have to wait may have a longer wait

More General Information on Other Small Business Grant Opportunities

In today's competitive business landscape, securing funding to small business grants can be critical to success for small businesses especially during times of uncertainty and financial downturns. Fortunately, there are numerous free grant opportunities available in the United States to support entrepreneurs and small business owners. In this comprehensive guide, we'll explore various small business grants, shedding light on the funding options that can help your business thrive.

Section 1: Definition of what Are Small Business Grants

Small business grants are non-repayable funds provided by government agencies, nonprofits, and private organizations to help entrepreneurs and small business owners achieve their goals. These grants are designed to stimulate economic growth, foster innovation, and create jobs within the local community.

Section 2: Federal Small Business Grants

Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs: These federal programs provide grants to small businesses engaged in research and development activities. Eligible businesses can receive funding to fuel innovation and develop new technologies.Small Business Administration (SBA) Grants: The SBA offers various grant programs, such as the SBA's Small Business Development Centers (SBDCs) and the Women's Business Centers (WBCs), which provide support and funding opportunities to entrepreneurs and small business owners.

Section 3: State and Local Small Business Grants

State Grants: Many states offer grants to support local businesses. Examples include California's California Small Business COVID-19 Relief Grant Program and New York's Empire State Development Grant Programs.Local Grants: Local governments and municipalities also provide grants. Check with your city or county economic development office for information on available grants, such as facade improvement grants or small business incentive grants.

Section 4: Nonprofit and Private Grants

Community Foundations: Many community foundations across the United States offer grants to small businesses that contribute to the betterment of their communities. These grants may focus on various sectors, from education to healthcare.Corporate Grants: Some large corporations have grant programs to support small businesses, particularly those aligned with their corporate goals or values. Research and reach out to corporations that may be interested in your business's mission.

Section 5: Eligibility and Application Process

Understanding eligibility criteria and the application process is crucial when applying for small business grants. Typically, eligibility requirements may include business size, industry, location, and the purpose of the grant. Each grant will have specific guidelines and deadlines, so be sure to thoroughly research and follow the application instructions.

Section 6: Tips for a Successful Grant Application

Thorough Research: Tailor your application to the specific grant, showcasing how your business aligns with the grant's objectives.Strong Business Plan: A well-documented business plan can make your application more compelling, demonstrating your commitment to success.Clear Financials: Provide clear financial statements and projections to illustrate your business's financial health and growth potential.Engage with the Community: Highlight how your business positively impacts the community, as many grants prioritize community development.

Final Tips on Applying to Other Small Business Grants

Small business grants in the United States are valuable resources that can help your business grow, innovate, and thrive. By exploring federal, state, local, nonprofit, and private grant opportunities and carefully preparing your applications, you can increase your chances of securing the funding needed to achieve your business goals. Remember that persistence and attention to detail are key when navigating the world of small business grants.

Want to Also earn

high commission

by referring

business owners?

Check out our Easy Work From Home Site Below and Start a Second Stream of Income!

*Showspaces is an affiliate marketing partner with ERC Together and makes a commission for any referral that sign up with our referral link and receives a tax refund processed through tax specialists with ERC Together. No up-front fees are required as ERC Together only charges on the back end only after an income tax refund is processed then received by the business owner.